If your CPA keeps emailing you with “just one more question,” you’re not alone. Every February, auto repair shop owners hit the same frustrating cycle. You send over your books, assuming everything is ready. Then the follow-up emails start. Requests for clarification. More documents. More explanations. Suddenly, tax filing slows down, stress ramps up, and […]

Why Your CPA Keeps Asking for More Information (and How to Fix It)

January Tax Deadlines Every Auto Repair Shop Owner Needs to Know for 2026

For auto repair shop owners, January isn’t just the start of a new calendar year. It’s a critical month for tax deadlines, payroll reporting, and year-end bookkeeping. Staying ahead of January’s compliance requirements can save your shop from penalties, missed deductions, and unnecessary stress during tax season. If you want to keep your auto repair […]

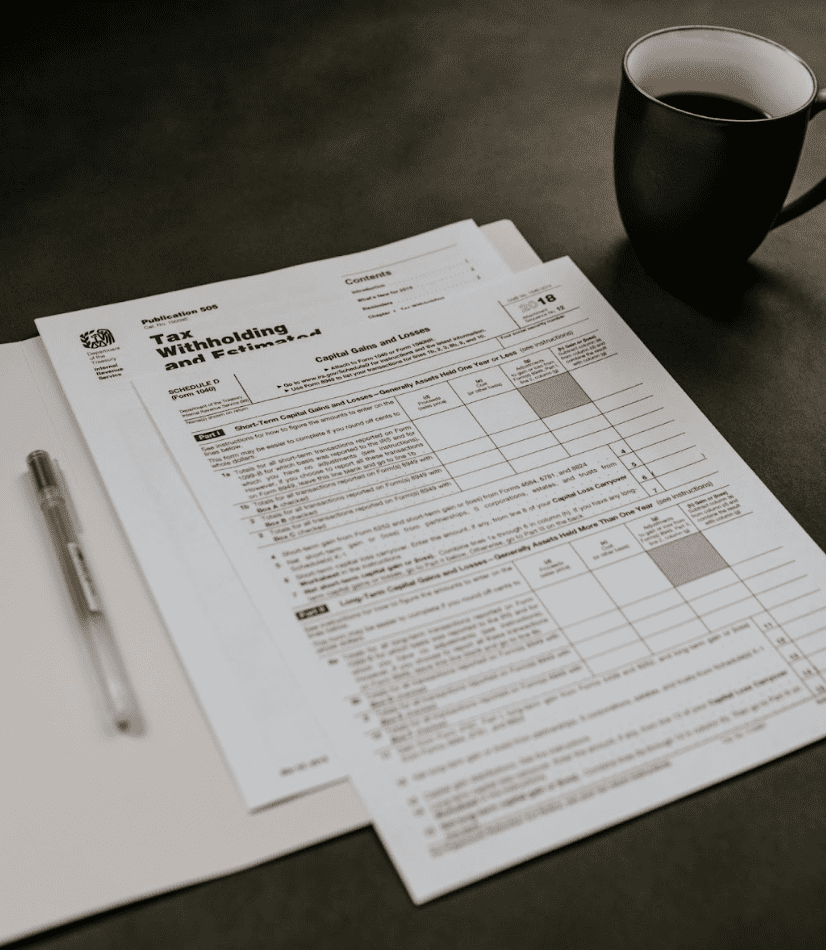

Estimated Tax Payments Due September 15: What Auto Repair Shop Owners Need to Know

If you own an automotive repair business, there’s a date you don’t want to ignore: September 15. That’s the deadline for making your third-quarter estimated tax payment for 2025. While it might feel like just another item on your already full to-do list, estimated taxes are a critical part of keeping your business in good […]

How to Prepare for Third-Party Payment Reporting Before Year-End

What Auto Repair Shops and Small Businesses Need to Know About the New 1099-K Rules For years, small business owners have leaned on tools like PayPal, Stripe, Venmo, and Square to streamline payments. But with shifting 1099-K reporting rules finally clarified by the One Big Beautiful Bill Act (OBBBA), it’s time to take a closer […]

What the New R&D Expensing Law Means for Your Auto Repair Shop’s Bottom Line

How small businesses can benefit from investing in innovation under new tax provisions. If you’re improving how your shop runs, whether that’s testing new tools, tweaking your internal systems, or upgrading your tech, you could be sitting on a hidden tax break. Thanks to a recent change in tax law, immediate R&D expensing is now […]