By - October 3, 2025

Categories: Bookkeeping, Financial Reports, Report

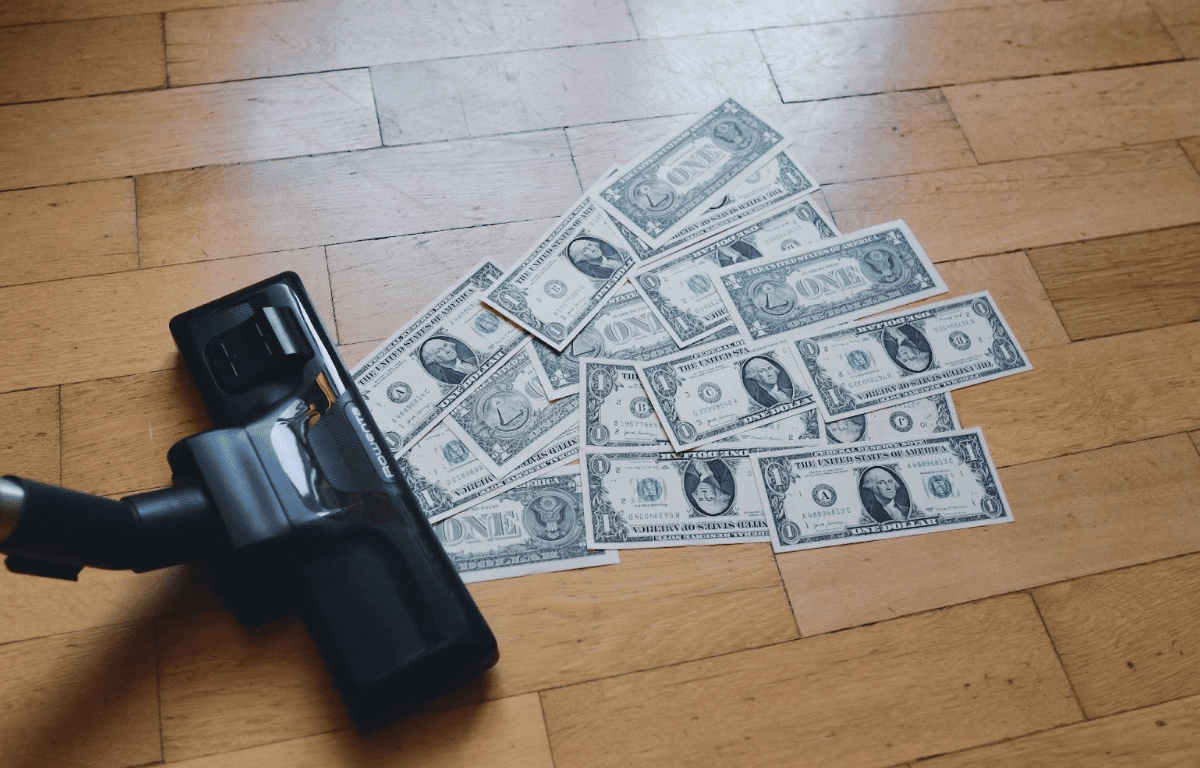

Running an auto repair shop isn’t cheap. Between payroll, parts, equipment, rent, and insurance, cash can get tight. And when you’re short on funds, the lure of a “fast and easy” loan can feel like a lifesaver.

But not all business loans are created equal. Some can help you grow, but others can bleed your shop dry. Predatory lending products like merchant cash advances or credit card stacking often come with sky-high interest rates and hidden fees that keep you in a cycle of debt.

Let’s talk about the dangers of these loans, and then look at safer alternatives that can actually support your shop’s long-term success.

Merchant Cash Advances: Fast Money at a High Price

Merchant cash advances (MCAs) sound great at first. A lender gives you a lump sum, and you pay it back with a percentage of your daily sales. There’s no fixed interest rate, no lengthy approval process, and funds usually hit fast.

The problem is that “easy” money can come with an effective APR of 40–200%. Because repayment comes straight out of your shop’s sales every day, cash flow gets squeezed, sometimes before you’ve even paid your techs or ordered parts.

Real-World Scenario:

One shop owner we worked with needed $20,000 to buy a new lift. An MCA gave him the money in less than 48 hours, but by the time it was paid off, he’d shelled out nearly $45,000 thanks to daily repayments and hidden fees. The lift was useful, but the debt nearly shut down his business.

Credit Card Stacking: More Credit, More Problems

Credit card stacking happens when lenders open multiple business credit cards for you all at once to create quick access to capital. On paper, it looks like a smart way to boost available credit.

But credit cards come with interest rates of 20–30%, annual fees, and steep penalties if you miss a payment. Managing multiple cards quickly becomes overwhelming, and one slip can snowball into thousands in extra costs.

High-Interest “Easy” Business Loans

There are also online lenders that advertise same-day business loans with “no hassle” approvals. While the speed is appealing, the hidden costs are not. Many of these loans include origination fees, daily repayment schedules, or balloon payments that hit hard when you least expect it.

In the end, you can end up paying back far more than you borrowed, and often at the expense of your shop’s day-to-day cash flow.

Safer Alternatives for Auto Repair Shops

Not all loans are bad. In fact, when chosen carefully, the right financing can be a powerful tool for growth. Here are some safer options to consider:

SBA Microloans

Backed by the Small Business Administration, these loans go up to $50,000 and typically carry much lower interest rates (usually between 8–13%). They’re a good fit for small shops needing working capital, new tools, or minor upgrades.

Community Banks and Credit Unions

Unlike big banks, local institutions often take the time to understand your business and your role in the community. They may offer more flexible repayment terms and lower rates, making them a smarter partner in the long run.

Business Lines of Credit

Rather than taking out one lump-sum loan, a line of credit lets you borrow only what you need when you need it. You’ll typically get better rates than with a credit card, and you only pay interest on what you use.

Cash Flow Planning

Sometimes the best alternative isn’t another loan at all. By building a cash flow forecast, you can predict slow seasons, plan for expenses, and create a reserve fund that keeps you from borrowing in the first place.

Final Thoughts

It’s easy to feel pressured into taking whatever loan you can get when your shop is in a crunch. But predatory products like merchant cash advances, credit card stacking, or high-interest “fast” loans often solve today’s problem while creating a bigger one down the road.

Instead, consider safer funding options, such as SBA microloans or community banks, or focus on stronger cash flow planning to avoid borrowing in the first place.

At Three Rivers Bookkeeping, we help auto repair shops gain clarity on their numbers, enabling them to make informed financial decisions and avoid loan traps that drain their profits. Reach out to us today to learn more about our financial services!