Fraud isn’t just something that happens in big corporations. It can (and does) happen in small businesses, too. And for many auto repair shop owners, fraud doesn’t always look like stolen cash or fake invoices. It can be as simple as an employee padding their hours, a vendor overcharging for parts, or a customer disputing […]

Shining a Light on Fraud: Protecting Your Auto Repair Shop During International Fraud Awareness Week

How Missed Payroll Deadlines Come Back to Haunt Your Shop

Running an auto repair shop means juggling a lot between customers, parts, technicians, and schedules. But there’s one area that can quickly turn into a nightmare if ignored, and that’s payroll taxes. Think of them as the “ghosts” of your shop’s back office. If you miss deadlines for FUTA, state unemployment, or payroll tax filings, […]

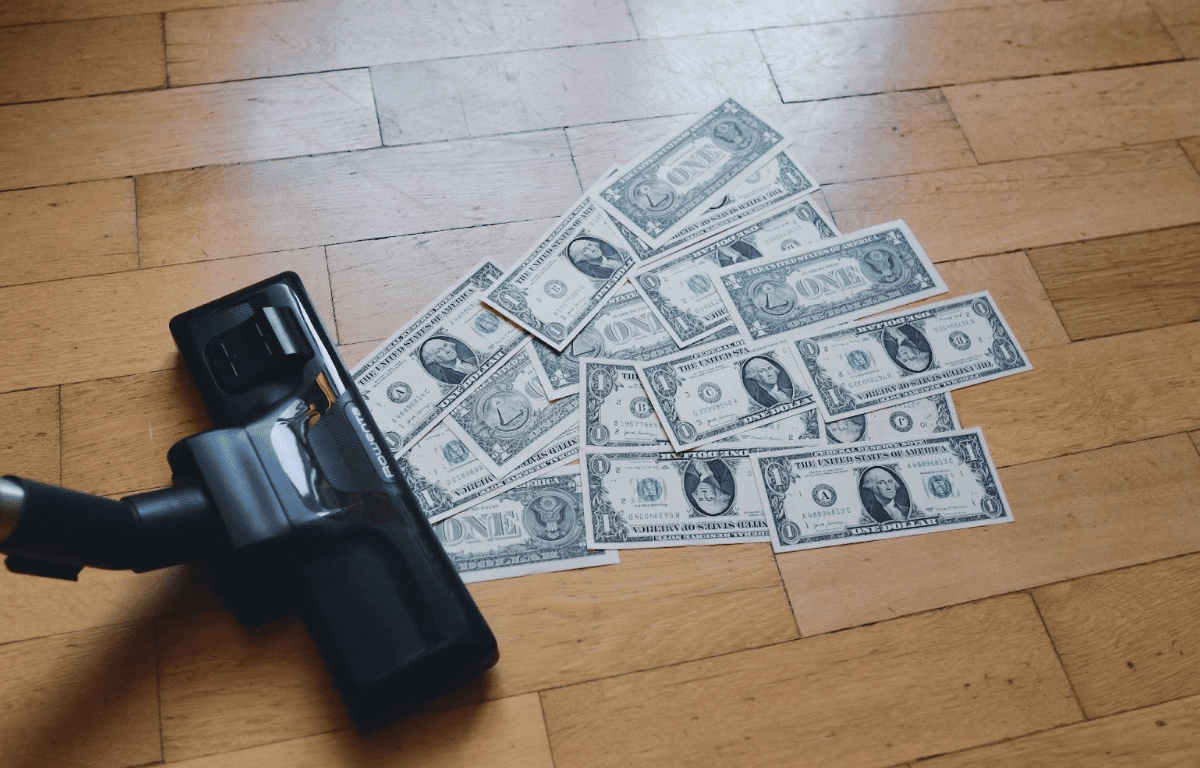

The Scary Side of High-Interest Business Loans: What Auto Repair Shops Need to Know

Running an auto repair shop isn’t cheap. Between payroll, parts, equipment, rent, and insurance, cash can get tight. And when you’re short on funds, the lure of a “fast and easy” loan can feel like a lifesaver. But not all business loans are created equal. Some can help you grow, but others can bleed your […]

Beyond the Slow Summer: Your Fall Auto Repair Shop Customer Re-Engagement Checklist

Summer can be slow for automotive repair businesses. Customers are on vacation, kids are out of school, and routine maintenance gets pushed to “later.” But with fall here, it’s the perfect time to re-engage your customer base and boost revenue before year-end. Here’s your step-by-step checklist to bring customers back, fill your bays, and keep […]

Estimated Tax Payments Due September 15: What Auto Repair Shop Owners Need to Know

If you own an automotive repair business, there’s a date you don’t want to ignore: September 15. That’s the deadline for making your third-quarter estimated tax payment for 2025. While it might feel like just another item on your already full to-do list, estimated taxes are a critical part of keeping your business in good […]